DLS Financials

Savings Accounts

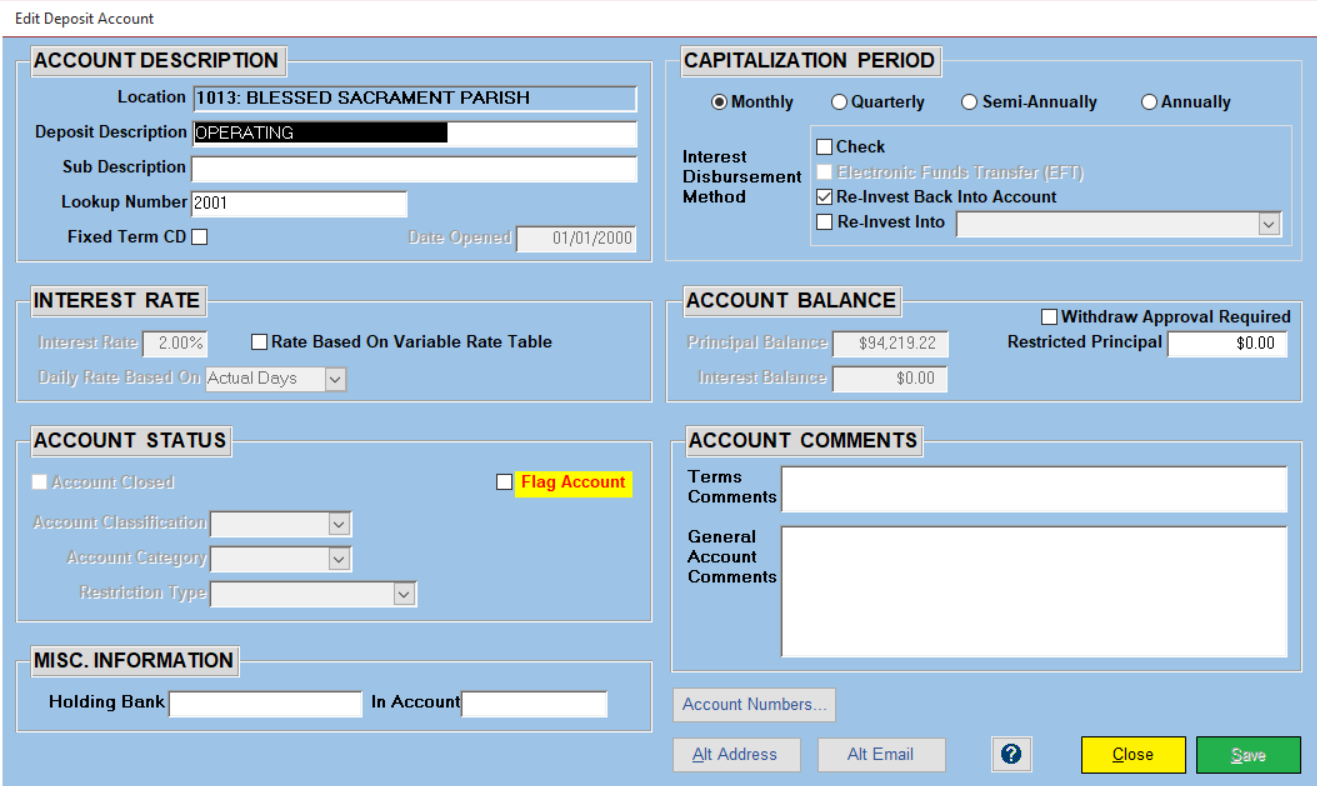

There are several settings for savings to make each account act differently. You can have an unlimited number of accounts in DLS and have each one act differently and affect different GL accounts in your accounting system. For the most part, deposits are calculated as simple interest that can be compounded daily, monthly, quarterly, semi-annually, or annually depending on your needs. There are four ways to pay out the interest: Reinvest back into the account, Invest into a different deposit account for the location, Send a check to the location, or Send the funds via EFT to the bank account of the parish via the accounting system.

Savings accounts can also be set up as Fixed Term CDs. This is more of a classification as the interest is calculated the same way as other savings accounts. But at the end of the term, you will be presented with an option to rollover the term, set a new term, or pay out the funds. There has been no request to limit CDs to prevent withdrawing of funds before the end of the term or locking the rate but it doesn't mean that it can't be added to the system.

All savings accounts have the option to have the interest rate be variable based upon an established chart of balances that determine the rate that the account's interest will be set to at the end of a period. The balance can be based upon Average Daily Balance over the period or the end balance of the period. The rate can also be changed for the next period or go back to the start of the period that is ending and recalculate the interest at the rate that the account should have had for the period. Each account can be calculated on 360-day year (30 days per month), 365-day year (no Feb 29th), or actual days in the year.

While there are rules with every diocese of how to process withdrawals, some accounts may need special approval. In this situation you can turn on a warning so that when a withdrawal is entered, the user will be asked if the special approval has been received. If there are other special rules for an account, you can put them into the terms or comment area and then flag the account so that every user that enters the account will be alerted to the read those fields before working on the account.

Restricted balances are handled in one of two ways. You can enter a restricted amount that the location cannot touch for a period of time and when interest is capitalized at the end of the period, that amount will be considered unrestricted and can be withdrawn while the original principal cannot. Another way is to have a restricted account so that no withdrawls are allowed on it. When the interest is capitalized you would have that interest moved to the principal of another account that is not restricted.

Every deposit account can be assigned their own set of GL numbers that they should affect in the accounting system. The defaults are always used when the account is first created but the user will have the option to change those numbers at any time. If the account is a special account that needs to let a particular person receive communications about, you have the ability to add an email and physical address to send those communications.

The deposit record holds the current information about the account as well as the rules by which to process interest.

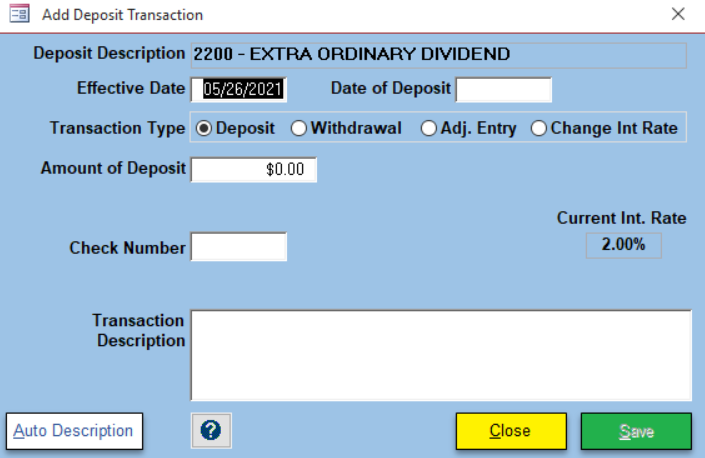

All transacations for deposit records are handled with the same form. Just click on the type of transaction you want to enter and the fields will change to what you need to complete the task. Auto Desciption is the description that would be put in if you don't enter one. Standard Description allows you to select a description that was written from a list.